PROMOS Household-related services in accordance with Section 35a of the EStG (German Income Tax Act)

Seamless presentation of household-related services in accordance with Section 35a of the EStG (German Income Tax Act)

In accordance with Section 35a of the EStG, the taxpayer can deduct the costs for household-related services from the amount of tax payable. This also applies to costs and services of tenants that they did not order themselves but that were initiated by the landlord who then transferred them to the tenant through the operation cost settlement. There is no solution for mapping these types of costs in the SAP® standard.

In PROMOS.GT, the costs for household-related services, for example garden maintenance work, building cleaning or winter services, are labelled as such directly at the time of posting. The advantage of labelling in this manner is that the household-related services can be shown in the utility statement, thus meeting the landlord’s requirement to provide evidence of the household-related services in accordance with Article35a EStG.

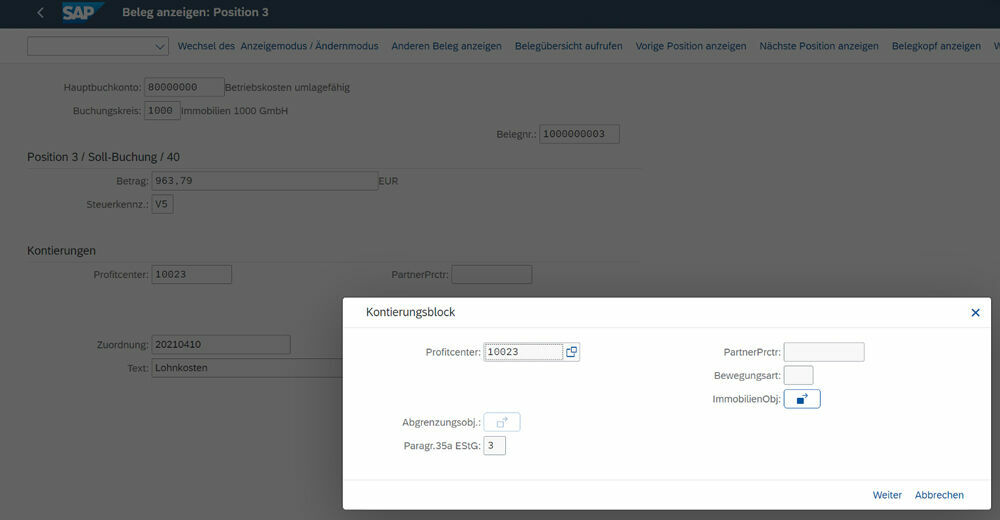

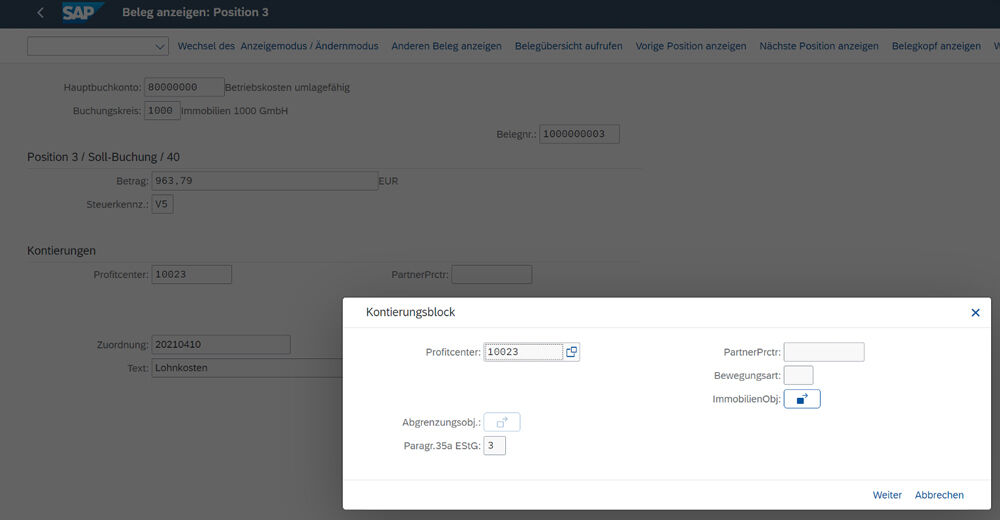

In SAP®, all costs that represent operation costs and are transferred as part of the utility statement are posted to billing units. PROMOS has added the additional field “Household-related services” in the posting document, which can be used to label labour costs as such directly when posting. The type of labour is classified via a catalogue selection, e.g. “household-related services” or “tradesmen’s services”.

In addition, in PROMOS.GT, wage costs that are relevant for utilities are posted to billing units created specifically for this purpose. A corresponding check makes it mandatory to specify the ID described above when posting a wage settlement unit. This procedure ensures that all wage costs are labelled as such and are specified by wage type.

In the letter regarding utilities, all wage costs incurred are determined based on the ID and shown in an appendix created for precisely this purpose. The tenant can submit this appendix to the tax office together with the tax declaration. Classifying the labour at the time of posting makes it possible to show the wage costs arranged by wage type in the utilities letter. In the PROMOS “Modular Utility Statement Letter”, the wages appendix is available as a key component, but this is not a mandatory prerequisite for showing the wage costs.

Further information

The system also ensures that the household-related services are mapped for automatically generated postings.

Management contract: When using the SAP® real estate contract to map the management contracts, you have the option to save the wage indicator in the contract. As part of periodic posting, the ID is automatically saved in the posting document.

Master settlement unit: When using master settlement units (MSU), which are used for mapping the advance deduction and total cost statement, the “Household-related services” field was also implemented. Provided the MSU costs are allocated to a wage settlement unit, the indicator is automatically saved in the document when the MSU is billed.

Your benefit

Tenant’s entitlement: The housing company complies with the tenant’s entitlement in accordance with Article 35a EStG for the wage costs that have arisen to be presented.

Tenant’s satisfaction: The appendix to the letter regarding utilities is prepared in a manner that allows the tenant to attach it directly to a tax declaration.

Time savings: Because the wage costs are labelled directly as part of posting, time-consuming post-processing or calculation of the wage costs is not necessary.

Transparency: Thanks to the wage indicator and the use of wage settlement units, incurred wage costs can be determined at any time with the aid of the SAP® standard reports. It is not necessary to calculate the wage share.

References

End user

- Utility cost clerks

Technical requirements

- SAP® RE-FX

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany