Attention everyone! With CGI, a new, uniform standard for outgoing payment transactions is coming your way

What does CGI actually mean?

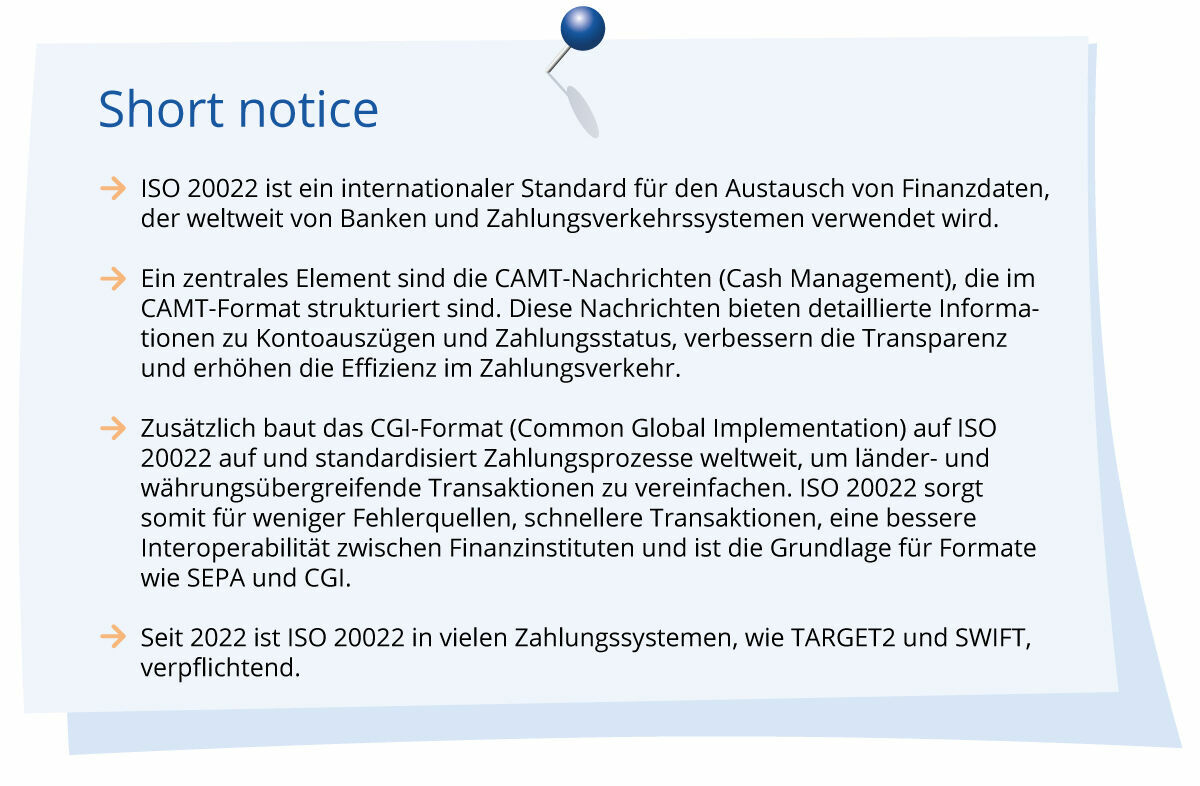

The CGI format is based on ISO 20022, the international standard for the exchange of financial data, which is already used in many countries and at financial institutions. The new CAMT format for bank statements is also based on ISO 20022 and also aims to enable more efficient payment transactions. We reported on the switch last month. CGI makes it easier to harmonise bank accounts and financial systems worldwide and process payments more efficiently. The format reduces sources of error, optimises processing speed and ensures uniform standards that can be used on a global level.

Who is affected by the switch?

The switch to the CGI format affects all companies that handle payment processes via banks. This is particularly important for companies that conduct foreign payment transactions (FPT), as the advantages of global standardisation are particularly evident here.

Our support during the switch

Transitioning to the CGI format requires thorough preparation, for which we actively provide assistance. We not only support you with the technical implementation, but also give you strategic advice on the necessary steps to future-proof your company’s payment transactions. Some of our customers are already successfully using CGI and are benefiting from the clear advantages – such as better interoperability between banks and systems and faster payment processing.

Plan early: what you should do

To ensure a smooth transition, companies should:

- actively start working on the switch from January at the latest,

- ideally, first clarify with their bank whether it already supports the CGI format,

- contact our experienced consultants for project planning,

- avoid transitioning on their own if possible.

For companies that process cross-border payments, early action is particularly relevant because the switch to the CGI format involves greater effort. CGI creates a standardised global language for payment transactions for the first time and significantly reduces the complexity of international transactions.

Our experienced team is always at your disposal. If you have any questions about the switch or the process, please do not hesitate to contact us – we will help you master the transition to the CGI format successfully and on time.