SAP® BCM in a nutshell – How you can optimise your electronic payment interfaces

Just as the industry was being swept by staggering bailouts and stimulus measures, the German state-owned development bank KfW made what would become the most infamous money transfer in the history of the financial crisis. Although Lehman Brothers had filed for bankruptcy the night before, KfW wired the bank €320 million. Nobody had checked up on events at Lehman beforehand. Not surprisingly, the public poured ridicule on the company. This anecdote illustrates in grand style that unforeseen events can sometimes occur in the time window between the posting and release of a payment. Yet long payment periods are far from unusual for most companies. Upon closer inspection of the automated payment process, it becomes clear how important seamless banking communications – or, as in the case of the KfW, the releasing of payments – can be.

Automated money flow with a safety net

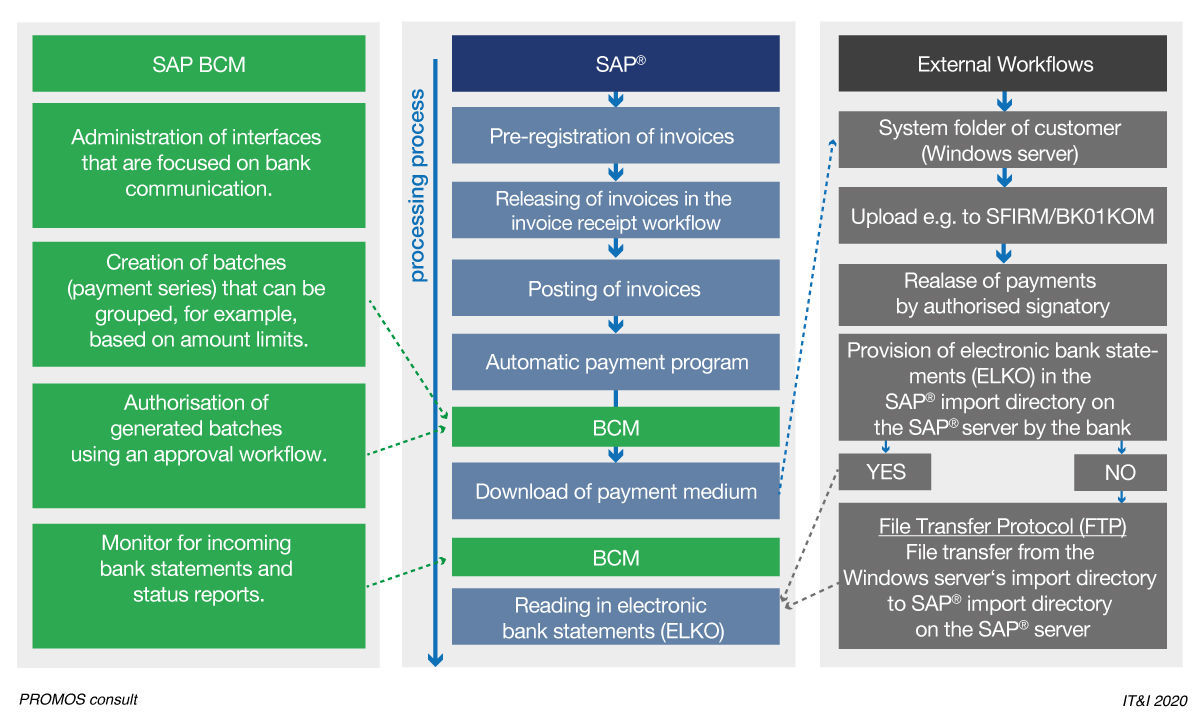

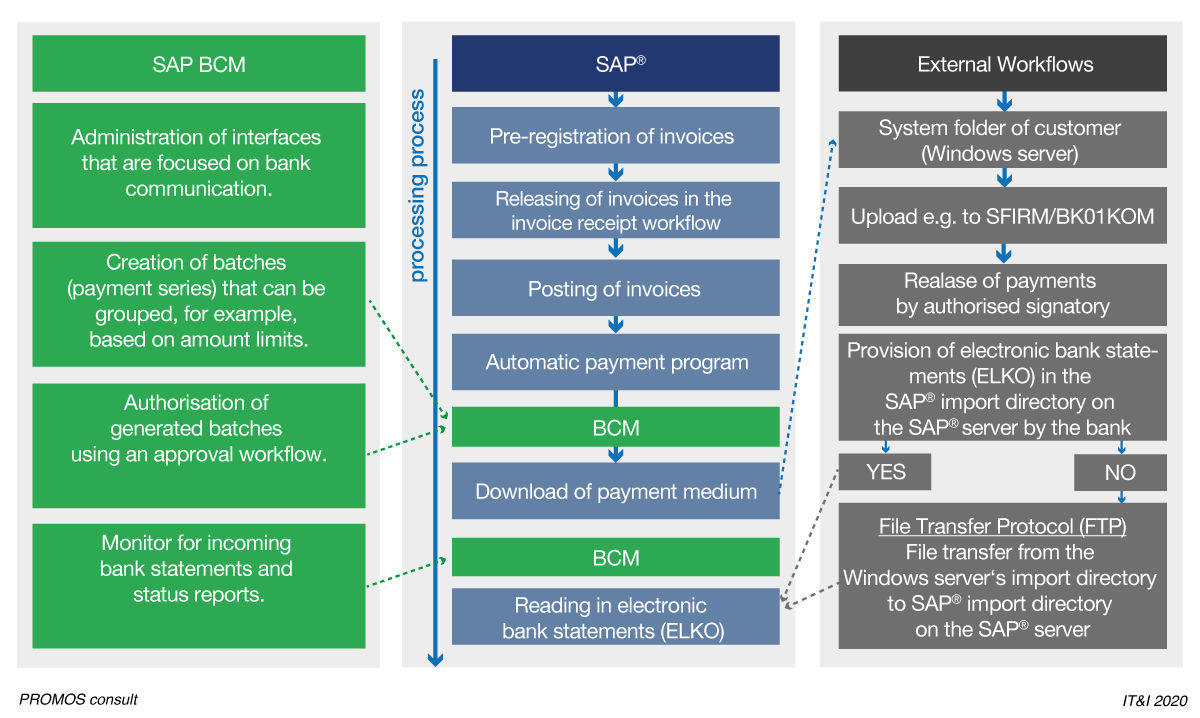

The details of the payment process will naturally vary from company to company. One example process is shown in Figure 1: Once the invoice has gone through processing in SAP® (meaning it has been parked, released and posted), it can then be authorised for payment and leave the company. It is passed on to the company's house bank through a payment medium. Once the payment medium has been read and successfully processed, the bank returns an electronic account statement, which is then automatically read into the SAP® system.

Figure 1: SAP® BCM targets weaknesses in the payment process and in data exchange with the bank.

Figure 1: SAP® BCM targets weaknesses in the payment process and in data exchange with the bank. |

The SAP® Bank Communication Management (BCM) makes targeted adjustments at the decisive points in this process to administer and effectively optimise communications with the banks. Payment processing is carried out in payment batches that can be combined according to requirements, e.g. by grouping payments according to amount limits. In addition to automated payment runs, the logical structuring of payments also particularly enables authorisation of these batches through an approval workflow in line with the dual or quadruple control principles. This method provides you with detailed knowledge of when money is leaving your company and grants you the security of being able to check the outgoing payment again.

A functional rainbow

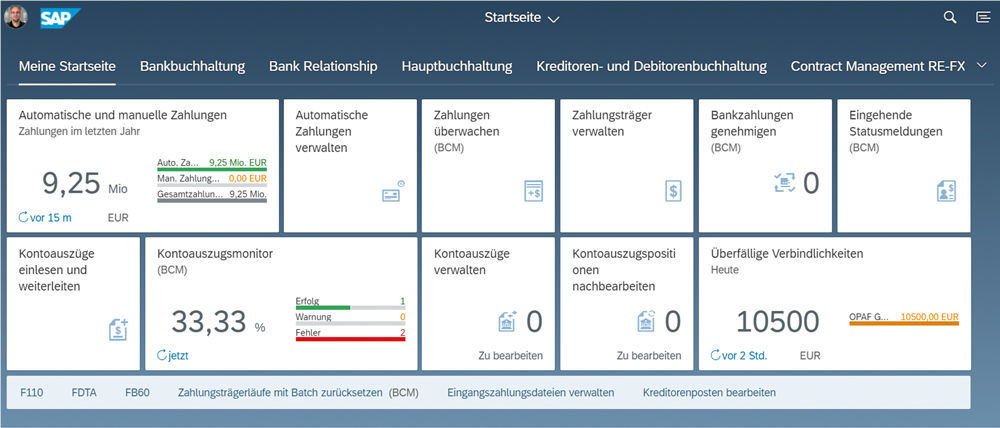

SAP Fiori® enables the deployment of SAP® BCM through a colourful array of applications that simplify daily handling in the payment process (Figure 2).

Figure 2: SAP Fiori® enables user-friendly operation of the many functions in SAP BCM.

The first step ensures efficient handling in the administration of payments, payment media and account statements. Those who have previously conducted payments with the standard payment program through transaction F110 will feel at home with the »Manage Automatic Payments« tile. Familiar functions such as creating payment recommendations, making postings or copying existing payment batches are given a significantly more user-friendly design here. If you would like more detailed information on the individual items in a payment run or want to jump directly to the payment medium, this is the right place. The management of payment media is also mapped in its very own tile. The data required for the electronic payment transaction can be transmitted to the bank via data medium through the »Manage Payment Media« app. A payment medium is created for every successful payment run, and the payment files are conveniently made available for download. If a payment requires a release according to the approval workflow, the »Approve Bank Payments« app signals with a number whether action is required of the respective employee. One click on the tile takes them to an overview and then to the payment awaiting approval. A clear split-screen display gives employees a clear overview of the approval, and the easy navigation into the various levels provides answers to questions such as: What is the payment? Who is the vendor? And which stage is the process currently at? SAP has added a special feature for issuing approvals whereby files can now be added as attachments via drag-and-drop.

As the information makes its way back from your bank to your company, three other apps aid you in processing the bank statements. First, the electronic bank statements (ELKO) are read into your SAP® system with the »Import and Forward (Automatically)« app. Error messages log whether, for instance, there was too large a difference to clear the items. This method will be recognisable right away to users of the previous transactions. In such cases, you can turn to the clearance function in the app »Postprocessing of Bank Statements«. With just a few clicks, you can select the affected item and clear it using a clearing account. Simulation and posting, including creation of a posting document, are also possible in this app. The »Manage Bank Statements« app aggregates the status of all bank statements into an overview, eliminating the need to call up a separate report.

To ensure transparency of all procedures within the payment process despite the high degree of automation, a second group of applications in your dashboard aids you in monitoring the process. In addition to the »Monitor Payments« app, which lets you track the process and your batches, the »Bank Statement Monitor« app is another key feature of SAP® BCM. It shows you the import status of statements from the individual bank accounts. Here, you can determine the exact date when a bank statement was successfully processed, among other things. This function also readily identifies bank statements that have arrived late or not at all, as well as any difference between the balance on a bank statement and the balance of the internal G/L account. Additionally, the »Display Incoming Status Messages« app displays information on whether the payment medium was accepted by the bank. The notification “File could not be processed” confirms the successful data exchange. To maintain a complete overview for those in charge of accounts payable, the »Manual and Automatic Payments« app rounds off the suite of applications by attractively visualising all payment runs. The payment data can be filtered by various categories including company code, vendor, currency and user. The user recognises who has initiated which payments right away without searching. The use of different colours enhances the graphic analysis.

Perfect combo

The combination of transactional and analytical apps of SAP® BCM in Fiori® represents the ideal toolbox for financial accountants. If we envision that the volume of electronic payment transactions will double every ten years, it is only logical that companies are increasingly automating their processes in this area.

Carefully considered workflows with processor finding and substitute rules integrate seamlessly into the role-based design of SAP Fiori®. The efficiency of automated processes and the level of control through intelligent monitoring functions complement each other perfectly and guarantee total transparency in all payment flows. You gain detailed knowledge of when payments are leaving your company in real time, letting you avoid any nasty surprises.

Author:

Thomas Banasiak

Consultant Financials

PROMOS consult

Other articles by this author: