Rental accounting in SAP® made easy – useful PROMOS enhancements for accounts receivable accountants and receivables managers

Multiply this scenario by a thousand and you have a small idea of a receivables manager’s day-to-day tasks. In addition, open items need to be managed or rental payments assigned to the right contracts in a central administration system such as SAP®. To simplify the rental accountant or receivables manager’s tasks, PROMOS has developed a few useful reports and easysquare workflow-supported processes for your SAP® system.

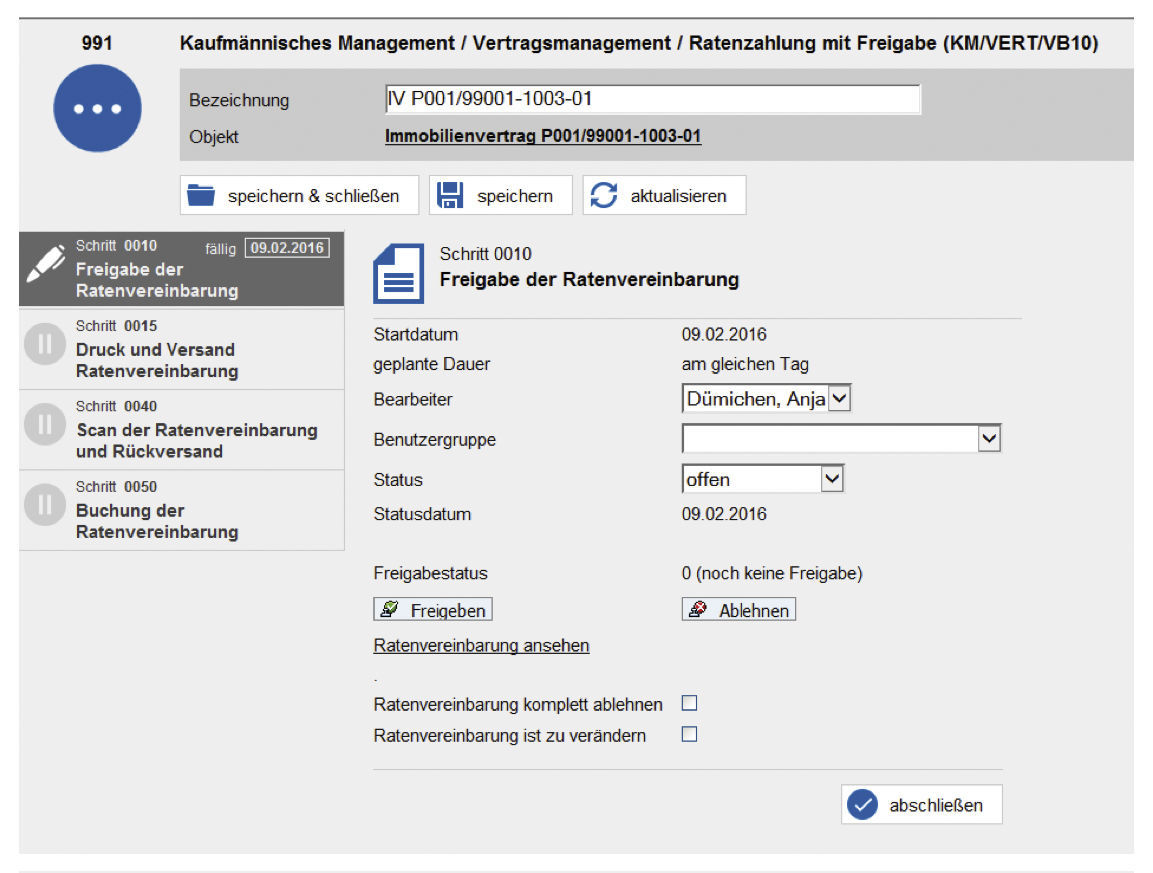

When the tenant defaults – the installment payments process with easysquare workflow

If a tenant defaults on his payments, this automatically means a loss of income for the landlord. This situation needs to be rectified as quickly as possible. Sometimes a small reminder is sufficient, but in some cases the tenant is simply not able to pay back the outstanding amount. In such cases, an installment payments agreement has proved effective.

The option to make an installment payment is already available in the standard SAP® system: the amount of the installments and their due dates are specified in the system for the open items in question, printed and, if required, posted immediately. So far so good. However, in the past a crucial hitch became apparent at this point; there was no option to temporarily save the data between the creation of the installment payments agreement and the posting. And the values need to be saved, as the posting can only be made once the tenant has signed the installment payment agreement. The installment payments process in easysquare workflow solves this problem in a clever manner and even provides additional useful functions.

With

the easysquare installment payments process, the save option that had been

missing until now can be performed. As soon as the installment payments

agreement has been saved in SAP®, a process is triggered in easysquare

workflow. If required, this can contain an individual release strategy. In this

case, the installment payments agreement is initially transferred to a releaser

who can be specified individually. This person can view, release, reject with

correction requests or, if required, independently modify the installment

payments agreement from directly within the process. Depending on the decision

made, the creator of the installment payments agreement automatically receives

the step to print, change or cancel the installment payment. Housing companies

with many process participants and multiple hierarchies benefit particularly

from a release strategy of this type. For example, one company that uses the

installment payments process is TAG Immobilien AG.

The printed agreement is sent to the tenant for signing. Once the housing company receives the signed document again, the employee responsible can simply access the existing process and trigger the posting or cancel the installment payment process at the press of a button. In the standard SAP® system, the employee would have had to enter the all information from the agreement into the system again, as it would not have been possible to save the values in advance without posting. Now, employees are guided intuitively through the process, with the result that errors are avoided and valuable time is saved.

Alphabet soup in the reason for payment: optimising the electronic bank statement

If there is no direct debit for a lease-out, tenants usually pay the rent due by means of a bank transfer. In this case, tenants have to enter their tenancy agreement number in the transfer subject line manually to ensure that the payment can be clearly allocated. However, it is well known that this procedure is subject to errors. Frequently digits or letters are interchanged or missed out, or the subject is not filled in at all. It is then up to the rental accountant to allocated incorrect transfers to the right accounts.

The PROMOS post-processing tools for the electronic bank statement can be used to dispense with this effort. The most important of these are the electronic bank statement pattern search function and the memory effect. The pattern search interprets the specified reason for payment based on customer-specific search patterns, allowing incorrect transfers to be allocated to the relevant contracts automatically and in bulk. As the name already suggests, the memory effect complements the report with a “memory function”. This means that payment reasons that are regularly entered incorrectly are automatically translated once the rental accountant has corrected them once. This can, for example, be useful for transfers from a housing benefit office that always uses its own transaction number as the subject.

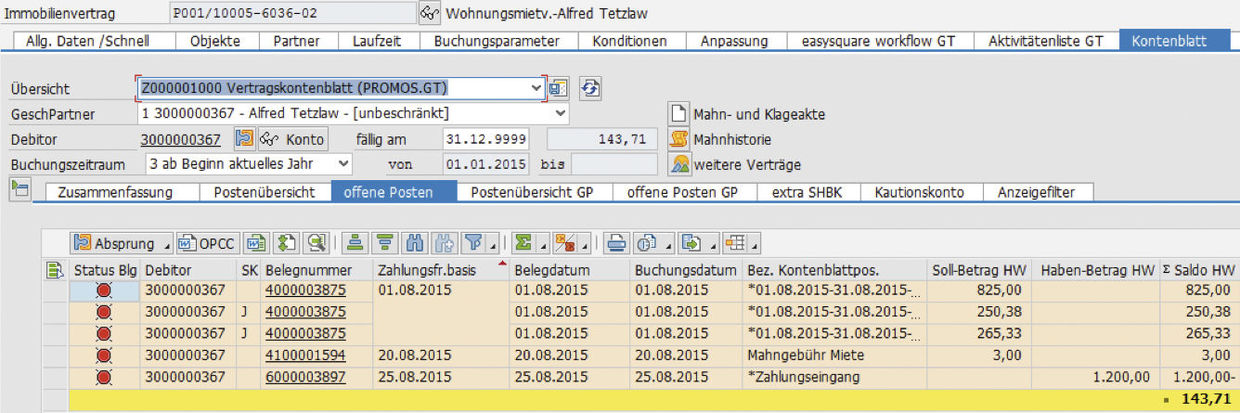

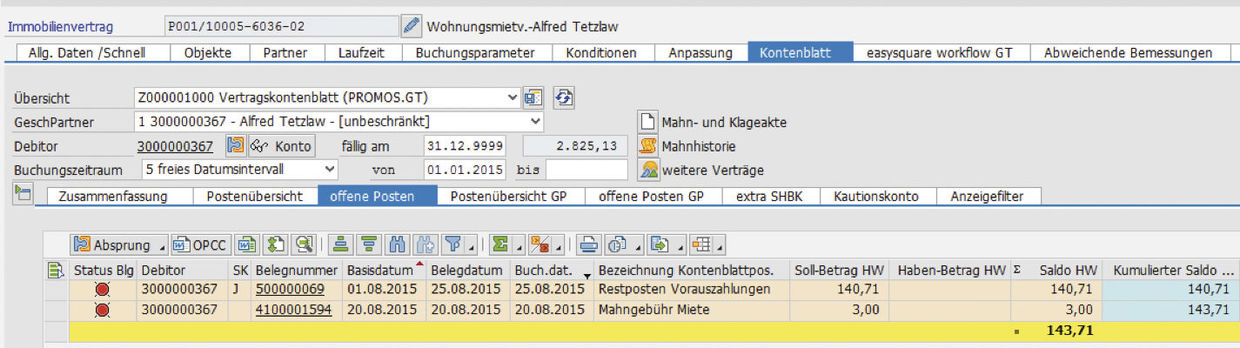

When TARGET does not match ACTUAL: automated clearing of open items including residual item creation

If a

monthly rent that is due is not paid by direct debit but is transferred by the

tenant or paid in cash, at housing companies this frequently results in

payments that are too high or too low. However, in the standard SAP® system,

open items are only automatically offset with payables or payments when the

balance of the overall contract is zero. Although there is also the option to

offset open items against each other in the scope of the electronic bank

statement, partial clearances and residual items cannot be formed. The incoming

payment clears open items provided the incoming payment amount is sufficient.

If the payment is more than the open item, an “excess payment” is posted as an

unqualified advance payment. Frequently, this overpayment logic does not

correspond to the desired account maintenance. Furthermore, this clearing logic

may be difficult for the rental accountant to follow. As a result, many

companies do not use it. So what does that mean for a company? The rental accountant

has to process each of the contracts manually and form the corresponding

residual items. How can PROMOS help here?

By means of a report that was developed especially for such cases, the clearing procedure for open items including qualified creation of residual items is executed automatically, in bulk and in a manner that can easily be traced. The report takes into account the posting rules specified by the housing company. The company can specify the sequence for clearing the individual rent components as well as create transaction type groups, which the report clears as a bundle. This mass account maintenance means the number and amount of open items can be reduced to a minimum in a very short time.

More time for the important things

The functions presented here simplify everyday working life for rental accountants and all others who are involved in the rental and installment payments process. The systematic processing of bulk procedures saves time without neglecting the required quality and individuality. Furthermore, this allows your employees to concentrate better on their core tasks.

Author:

Anja Dümichen

Director Real Estate Consulting

PROMOS consult