PROMOS Individual Value Adjustment

Measure claims efficiently – here’s how!

At the end of the year, outstanding claims from trade receivables from companies are re-measured. For example, if a customer’s creditworthiness has changed over time, this can affect the credit risk, which in turn has to be considered in measurement in accordance with the lowest value principle. The usual procedure for measuring claims is individual value adjustment; however, this requires a great deal of time and manual effort. A systematic analysis of the entire receivables portfolio also requires good analytical skills and a high degree of methodical knowledge regarding the analyses available in SAP®. The global value adjustment procedure, on the other hand, is far too imprecise to serve as a single measurement method that meets the requirements of the diverse claims structure with its countless individual circumstances.

For this reason, PROMOS has developed a solution for measuring claims that is a combination of the individual and flat-rate adjustment methods: the flat-rate individual value adjustment.

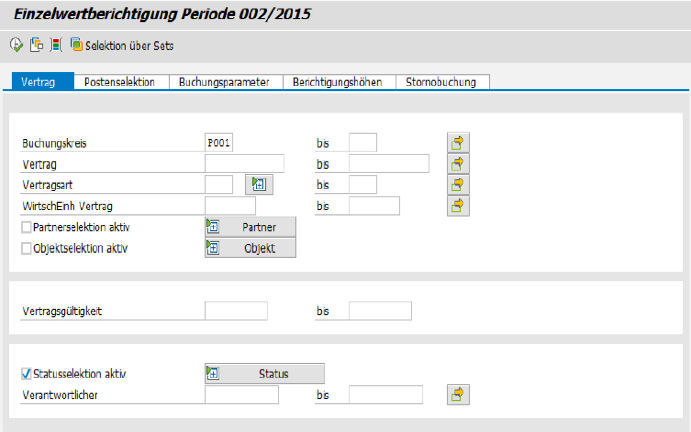

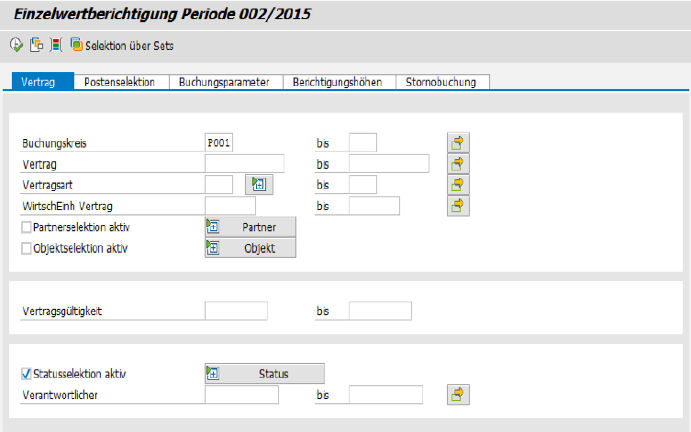

With flat-rate individual value adjustment, the claims to be measured are summarised in measurement groups based on individually definable characteristics, such as due date, contract type or dunning lock. Corresponding devaluation rates are then assigned to these groups. For example, a claim that has been due for 200 days is devalued more than a claim that has a due date of only 90 days. Automatic devaluation of the entire amount as soon as a certain dunning level is reached is for example also possible. A hierarchical measurement structure can also be mapped for the specification of the devaluation characteristics. In a value adjustment run, all claims assigned to a category are measured with the same devaluation rate. Thus, the same credit risk is assumed for all claims in the same measurement group. If the customer accounts still have open credit balances, these are offset against the outstanding claims.

This solution allows semi-individual measurement of large numbers of claims in a single work step, thus combining a reasonable amount of effort for the analysis with a sufficiently precise estimation of the risk by means of forming measurement groups. The only prerequisite is that sufficiently differentiated measurement groups are formed based on experience values. On the basis of the schematic measurement, this can be mapped in the form of an algorithm. Following this, after the devaluation per contract is determined, the responsible processor can check it and finally post it in accordance with the stored rules. The result of the report is summarised in a straightforward ALV list.

Further information

- Adjustment criteria: The following adjustment criteria are available for defining the adjustment amounts: due date, amount of the item, dunning lock, special G/L indicators, contract type, contract end date.

- Cancellation: The cancellation function can be used to reverse the adjustment of the values.

- Simulation: A simulation can be run before performing the adjustment and actual posting. The results of this simulation are presented clearly in an ALV list.

Your benefit

Quality assurance: The adjustment criteria are objectified and proper documentation of the measurement is guaranteed. The preciseness of the measurements also increases as a result.

Improved planning: The individual value adjustment runs can be planned for each job.

Efficiency through automation: Grouping of claims with the same characteristics, offsetting of customer credit balances, the consideration of manual derecognitions and integrated postings from the report make a significant contribution to efficiency.

Transparency: The results lists clearly presents all items in accordance with the selection and shows the measurement in accordance with the defined criteria in a flexible ALV layout.

End user

- G/L accounting

- Accounts receivable accounting

- Credit management

Technical requirements

- SAP® RE-FX

Please contact us:

PROMOS consult Projektmanagement,

Organisation und Service GmbH

Rungestraße 19

10179 Berlin-Mitte

Germany